New Insured Mortgage Option for New Builds: What You Need to Know!

Starting August 1, 2024, homebuyers in Canada will have a new mortgage option available for newly built homes. This initiative, introduced by the Canadian Mortgage and Housing Corporation (CMHC), aims to support affordable homeownership by offering insured mortgages with a 30-year amortization period. This change is expected to provide more flexibility and lower monthly payments for eligible buyers, particularly in competitive housing markets.

Key Features and Qualifying

Must be a first-time homebuyer: At least one borrower must be a first-time homebuyer. To be considered a first-time homebuyer, a borrower must meet one of the following criteria:

The borrower has never purchased a home before; or

In the last 4 years, the borrower has not occupied a home as a principal place of residence that either they themselves or current spouse or common-law partner owned; or

The borrower recently experienced the breakdown of a marriage or common-law partnership

2. Insured Mortgage Only: This new product applies specifically to insured mortgages. This means buyers who meet the eligibility criteria can secure a 30-year amortization with down payment as low as 5% but no more than 19.99%. A premium surcharge of 20bps will be applied to all insured mortgages with amortizations over 25 years.**

3. New Build Home: The qualifying property must be a newly built home. To be considered a newly built home, the property must not have been previously occupied for residential purposes.

4. Primary Residence: The home must be intended for homeowner occupancy. This means that the property must be occupied by the borrower, a person related to the borrower by marriage, common-law partnership, or any legal parent-child on a rent-free basis.

**Note that there are three mortgage insurers in Canada. CMHC, Canada Guaranty and Sagen. While all three insurers are offering this program, at the time of the product launch, CMHC and Sagen have the lowest premium surcharge of an additional .20BPS. If your bank or broker must use Canada Guaranty to obtain an approval, the insurance premiums are currently higher.

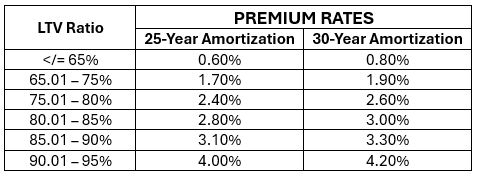

Insurance Premium Comparison

A premium surcharge will be included on all purchases with an amortization exceeding 25 years. Please see chart for the premium surcharge direct through CMHC.

Benefits to Homebuyers

Lets make some assumptions of a first-time buyer that may qualify for the program and determine which amortization period might fit their financial requirements best based on affordability and qualification amounts. Here are our assumptions:

Qualifying Income: $110,000.00 annually

Down Payment: 5%

Property Taxes: $3,250

Rate: 4.89%

Assuming no other debts or liabilities

No condo Fees

Based on the above assumptions, here is the outcome:

25-year amortized Mortgage

Maximum purchase price is $468,000

Monthly payments of $2,660.37.

OR

30-year amortized Mortgage

Maximum purchase price is $497,000

Monthly payments of $2,587.33.

Extending the amortization from 25 to 30 years not only increases the maximum purchase price, but also lowers the monthly payments, making homeownership more affordable. You will pay more interest over time with a longer amortization period, but the homeowners will have the option to make prepayments against the mortgage to further reduce interest, carrying costs and total life of the mortgage. This is assuming the interest rate is the same for the increased amortization and it's important to note that some lenders will surcharge the rates for the longer amortization period.

While the new insured mortgage option offers attractive benefits, prospective buyers should consider their individual financial circumstances and consult with a mortgage professional to determine if it aligns with their long-term goals. Factors such as interest rates, market conditions and personal financial stability should all be taken into account when making a decision.

The industry is still waiting for full details from the government on this program and in turn the lender policies as a result of this information. Stay tuned closer to August 1, 2024 for full details.